Mortgage calculator plus additional payment

Most people need a mortgage to finance a home purchase. Here are different payment methods you can try.

Online Mortgage Calculator Wolfram Alpha

Years to pay off.

. Pay this Extra Amount. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. Mortgage Amount or current balance.

Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Use the Mortgage Payment Calculator to discover the estimated amount of your monthly mortgage payments based on the. See our current mortgage rates low down payment options and jumbo mortgage loans.

Take a look at the following example. Our Closing Costs study assumed a 30-year fixed-rate mortgage with a 20 down payment on each countys median home value. Check out the webs best free mortgage calculator to save money on your home loan today.

Use our offset calculator to see how your savings could reduce your mortgage term or monthly. Includes taxes insurance PMI and printable. If you make a down payment of less than 20 with a conventional mortgage youll need to pay an additional payment for private mortgage insurance.

You likely have an additional months mortgage payment without realizing it. Make a 13th Loan Payment Each Year. The monthly payment and interest are calculated as if the mortgage or loan were being paid over this length.

The mortgage amount rate type fixed or variable term amortization period and payment frequency. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. Use our free monthly payment calculator to find out your monthly mortgage payment.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. For example a 30-year fixed-rate loan has a term of 30 years. The result will give you your new monthly all-in cost which includes your scheduled payment plus the additional principal payment as.

This will impact your monthly budget. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. Once we calculated the typical closing costs in each county we divided that figure by the countys median home value to find.

360 original 30-year term Interest Rate Annual. Most homeowners normally make monthly mortgage payments which is equivalent to 12 payments annually. Also choose whether Length of Amortized Interest is years or months.

And you can make additional principal payments to see how that also accelerates your payoff. If you start paying additional principal youll save a lot of money in interest. A general affordability rule as outlined by the Canada Mortgage and Housing Corporation is that your monthly housing costs should not exceed 32 of.

Also this is a US mortgage calculator with additional payments some options. First Payment Due - due date for the first payment. The additional amount you will pay each month over the required Monthly Payment amount to pay down the principal on your loan.

Our calculator includes amoritization tables bi-weekly savings. You must have at least 5 for a down payment if the home purchase price is less than 500000. Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance.

Mortgage Closing Date - also called the loan origination date or start date. Plus the more additional principal you pay the less interest youll pay over the life of the loan. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan.

See a breakdown of your monthly and total costs including taxes insurance and PMI. If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal. Whether youre determining how much house you can afford estimating your monthly payment with our mortgage calculator or looking to prequalify for a mortgage we can help you at any part of the home buying process.

Affordability calculator get a more accurate estimate of how much you could borrow from us. If your mortgage rate is lower than the inflation rate youll be paying. The 30-year fixed rate mortgage is the most common type of home loan but there are additional mortgage options that may be more beneficial depending on your situation.

These include making lump sum payments or shifting to a biweekly payment schedule while making additional payments. Certain other loans like FHA or USDA loans also require a similar monthly payment mortgage insurance premium or MIP regardless of the size of your down payment. It takes about five to ten minutes.

Mortgage payment The monthly mortgage payment is calculated based on the inputs you provided. The Loan term is the period of time during which a loan must be repaid. Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out.

We considered all applicable closing costs including the mortgage tax transfer tax and both fixed and variable fees. You can use a mortgage calculator to help you to find out this information specific to your current loan. Two times per year you are going to have three paychecks.

Bi-Weekly plus Extra Mortgage payment. In return the borrower agrees to pay back the loan plus interest over the course of 15 or 30 years. Found on the Set Dates or XPmts tab.

About Dates Interest Calculations - In the real world the time between the mortgage origination date and the first payment due date will seldom be equal to the payment frequency. To pay extra on your mortgage you can make. How much will my monthly mortgage payment be.

Offset calculator see how much you could save. Simple Mortgage Calculator - The advanced mortgage calculator with a down payment is designed to be a home mortgage calculator with many. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan.

For example if you require a lower interest rate adjustable-rate mortgages ARM offer a variable rate that may be initially lower than a 30-year fixed rate option but adjusts. Enter amount Please enter an amount for additional payments that is greater than 000 and less than. If youre thinking of refinancing your mortgage.

This is equal to the price of your home minus your down payment plus mortgage default insurance if youre putting down. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. A mortgage payoff calculator can help you.

Purchase price Down payment Amortization period number of years 1 Year 2 Years 3 Years 4 Years 5 Years 6 Years 7 Years 8 Years 9 Years 10 Years 11 Years 12 Years 13 Years 14 Years 15 Years 16 Years 17 Years 18 Years 19 Years 20 Years 21 Years 22 Years 23. And the starting date. Mortgage insurance is only available when the purchase price is below 1000000.

Your down payment affects the amount you can borrow to buy a home and the size of your payments. Mortgage Payment Calculator With Amortization Schedule.

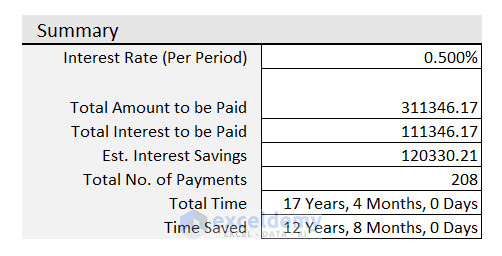

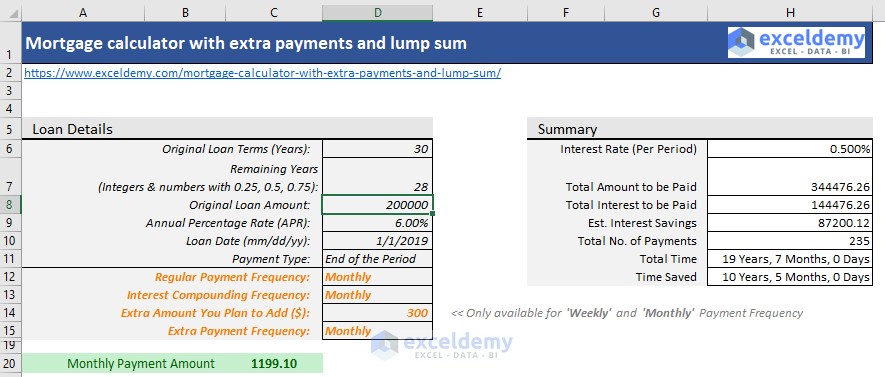

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Free Interest Only Loan Calculator For Excel

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Schedule Amortization Chart

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Download A Free Home Mortgage Calculator For Excel Analyze A Fixed Or Variable Rate Mortgage And Inclu Mortgage Loans Financial Calculators Refinance Mortgage

![]()

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator How Much Monthly Payments Will Cost

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Money Management Advice

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Extra Payment Mortgage Calculator For Excel

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template